Irish Life has completed a €133 million bulk annuity onboarding transaction with the trustees of Greencore plc’s Irish defined benefit pension scheme. It marks the largest bulk annuity transaction to take place in the Irish market over the last year..

The €133 million ‘bulk annuity’ contract is an insurance policy taken out by the Trustee of the Greencore Group pension scheme with Irish Life and is held by the Trustee as an asset of the scheme’s wider investment portfolio. The policy reduces the investment and longevity risk of the scheme by taking out insurance against these risks with Irish Life. The scheme sponsor, Greencore plc, has fully supported the process and views the transaction as a significant de-risking step for the scheme.

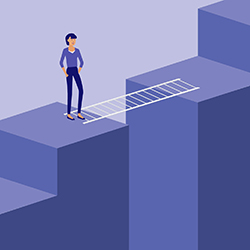

This type of pension risk transfer is now commonplace for maturing defined benefit pension schemes and 2022 saw €0.5bn in Irish transactions across a range of schemes. This Irish market is still dwarfed by the UK market however, which had over £35bn in transactions in 2022. The Irish pension risk transfer market is expected to see significant growth over the course of 2023 with the rise in interest rates, widening in credit spreads and improvement in scheme funding positions.

Commenting on the transaction, Oisin O’Shaughnessy, Managing Director, Irish Life Corporate Business said: “We are delighted to support the trustees of the Greencore scheme with this transfer, enabling their pension scheme de-risking strategy. This is an important step in providing further security for all members.

“At Irish Life we are seeing an increasing demand from companies who are looking to offload the risk of legacy defined benefit schemes from their balance sheet. We are working closely with businesses to support them as they manage their way through their pension lifecycles to secure member pensions.”

A spokesperson on behalf of the Trustee said: “This buy-in follows significant work by the Trustee and the Company over the last 12 months and forms a key step on our journey plan to de-risk the scheme and secure member benefits.”

John O’Brien of Mercer, who brokered this bespoke solution, commented: “We were delighted to assist the Greencore Trustees in executing this transaction, which included a number of innovative contract features that helped the Trustees to manage execution risk after the volatile market conditions of September 2022, and ensured that improvements in market pricing could be safely banked”, while Christopher Delaney, Head of Risk Transfer at Mercer, commented: “This transaction demonstrates the value of trustee groups and companies working with their advisors to proactively manage risks in ongoing pension schemes. Improving scheme funding levels have allowed a growing number of our clients to consider the strategic use of insurance solutions as part of the management of their defined benefit pension liabilities.”